The WTI price has strengthened in recent weeks but there have been wider CDN price differentials periodically throughout 2012 which have negatively impacted Canadian wellhead prices. We note that the light differentials have narrowed substantially in the last couple weeks results in significantly higher realized oil prices for producers.

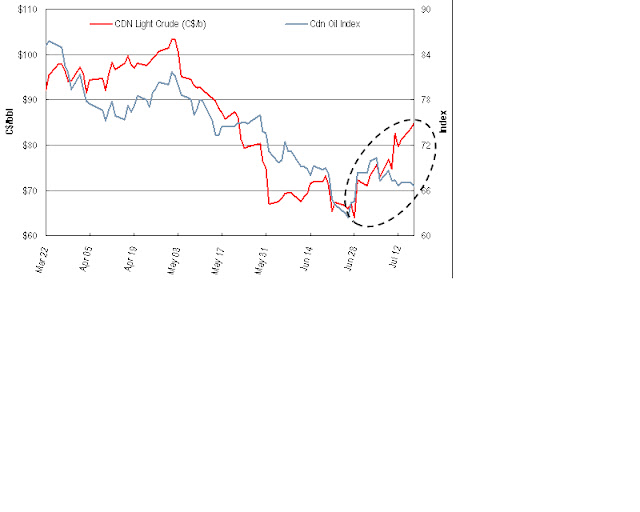

· The graph shows that the Canadian light Sweet Price (Net Energy) was trading at a of discount to WTI of $11.50/b or a CDN realized price of ~$65.00/b in late June.

· The discount in the couple weeks has narrowed significantly from $11.50/b to only $1.00 - $3.25/b currently. This narrowing combined with the improvement in WTI has significantly improved the realized price in Canada. The implied CDN light price as of last night was ~$85.00/b a $20.00/b improvement in the last 2.5 weeks.

· This trend is also seen in other light crude products. For example, Bakken crude at Clearbrook MN has increased from US$63.69/b on June 28th to ~US$88.50/b this morning.

The oil weighted equities have not reflected this realized price improvement

· No surprise but there is a strong correlation between the light crude price and oil weighted producers in our coverage universe. We have included a graph going back from March which shows that the two often move in lock step (corr. of 85%)

·

However, the recent strengthening in Canadian pricing has not been reflected in the share prices of the oil weighted producers and the relationship has diverged. The E&P’s that would benefit the most from the stronger pricing and sentiment would be the oil weighted producers.Cheers E